Workers and their families are spending a larger percentage of income on health care, especially in the South, a report says.

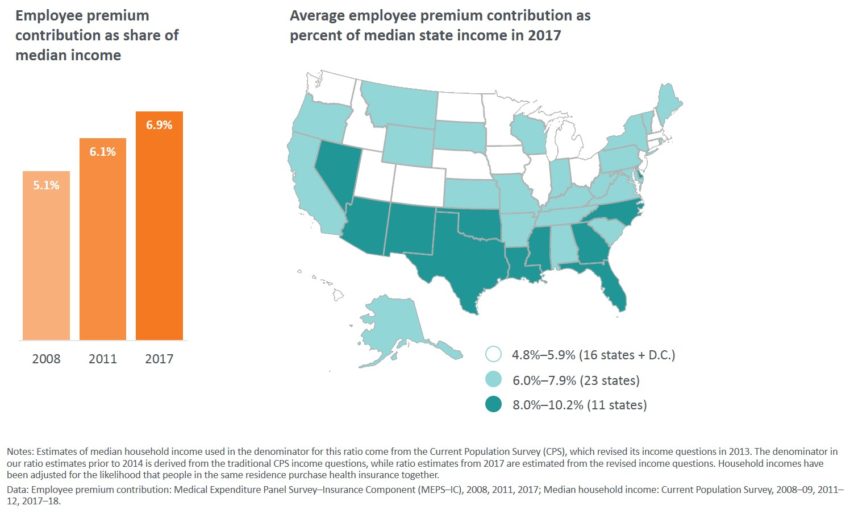

Average premium contributions by employees are 7 percent of median income nationally. But Georgia is among 11 states where these contributions for single and family plans amounted to 8 percent of median income or more, said the report from the Commonwealth Fund, released Friday.

Other Southern states in this grouping are Florida, Louisiana, Mississippi, North Carolina and Texas.

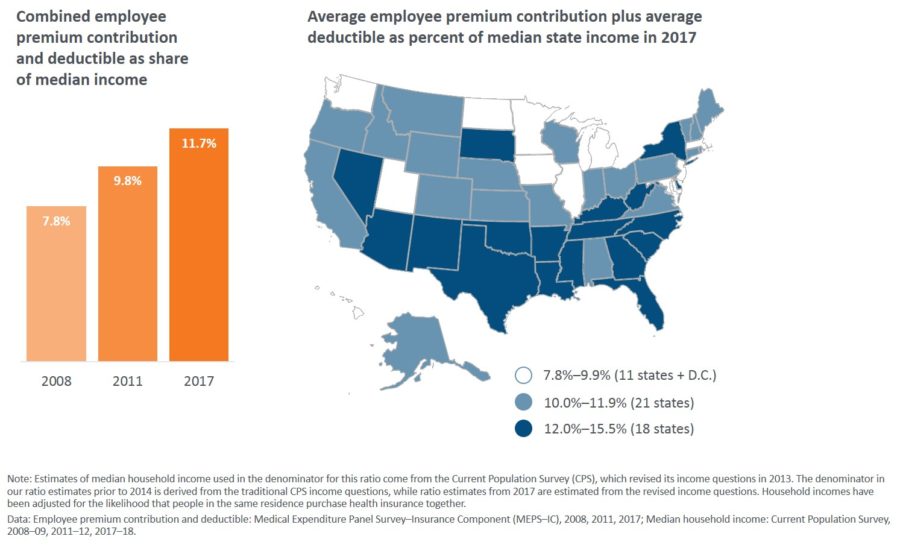

Adding deductibles pushes this financial share nationally to nearly 12 percent of median income in 2017. In Georgia, though, that premium and potential deductible spending reaches 13.8 percent of income.

The report uses data from the federal Medical Expenditure Panel Survey – Insurance Component, which surveyed more than 40,000 businesses in 2017.

“The vast majority of people under age 65 in the U.S., 152 million, get their health insurance through an employer, and many of them can barely afford to pay for it,” Dr. David Blumenthal, president of the Commonwealth Fund, said in a statement. “Several bipartisan policy fixes have the potential to reduce health care burdens for workers and families struggling to afford the health care they need, while also making our health system work better for everyone.”

The overall cost of health insurance for employers is lower in Georgia than the national average. But the level of income here and in the rest of the South weighs on the overall health care burden, according to Bill Custer, a health insurance expert at Georgia State University.

Median income is lower in Georgia and the South, he said Monday. “Georgians find health insurance and health care less affordable than in other states.”

Custer said the report illustrates the impact of health care costs on families with job-based insurance. “This is becoming less affordable for everyone.’’

Deductibles in Georgia increased across single and family plans, rising by 23.7 percent between 2016 and 2017.

The report noted that many people do not have enough medical expenses in a given year to meet deductibles. Some services, like flu shots and other preventive care, are covered by plans before members meet their deductibles.

Among families that do spend enough to meet their deductibles, those at the mid-range of the income distribution would spend 4.8 percent of their income on average before their coverage kicked in. In Georgia, the potential deductible share is 6 percent of income.

Among other findings in the report:

** After climbing modestly between 2011 and 2016, average premiums for employers nationally rose sharply in 2017. Annual single-person premiums climbed above $7,000 in eight states, and family premiums were $20,000 or higher in seven states and the District of Columbia.

** Rising overall employer premiums increased the amount that workers and their families contribute.

** People with job-based insurance pay about one quarter of their overall premium cost, on average. This has changed little in recent years. But in some states, employees and their families pay a larger share. In 14 states, including Georgia, people with family plans paid for 30 percent or more of the cost of their insurance.