Georgia employers’ health care costs are lower than the national average, a recent survey has found.

And the survey — done by New York-based Mercer, the world’s largest human resources consulting company — finds that employers in the Peach State offer what are called “consumer-driven health plans’’ at a greater rate than their national counterparts.

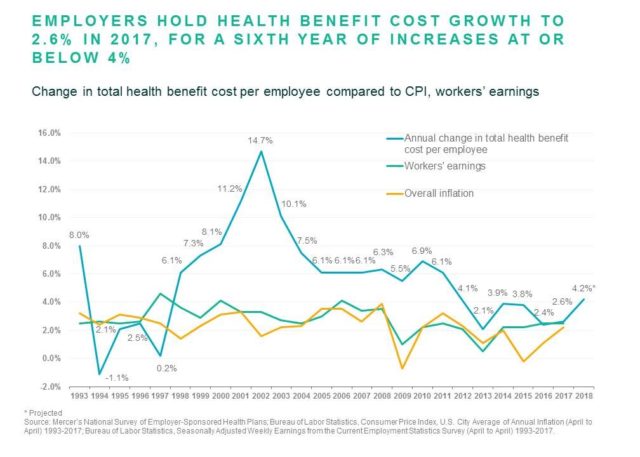

The Mercer survey, released last week, says that the 52 Georgia employers surveyed saw their health care premiums rise by an average of 2.6 percent in 2017, the same as the national trend.

The Mercer health benefits survey of randomly selected employers also found that this year’s premiums averaged $11,106 per worker, about 10 percent lower than the national average of $12,229.

“The cost of care in Georgia is generally less’’ than national norms, says Jennifer May, an Atlanta-based consultant in the health business at Mercer.

Georgia’s benefit costs are slightly lower than regional averages. In the South, total health benefit cost for active employees increased 4.2 percent in 2017 to $11,303 per employee, according to Mercer.

Half of the Georgia employers offer the consumer-driven plans, which feature lower premiums, high deductibles and a health savings account or health reimbursement arrangement.

Nationally, only 30 percent of employers offer such coverage.

“That’s one area that Georgia employers are ahead of the national trend,’’ May said.

The minimum individual deductible in these consumer-directed plans is $1,350 for 2018, she added.

The worker must meet the deductible before coverage kicks in, so the plan design aims to make the consumer more conscious of making good health care choices. (Preventive care is covered as a benefit outside of a deductible, as required under the Affordable Care Act.)

“An employee is spending their own money,’’ May said. The idea, she said, is that “they’ll make smarter, better choices to choose the most effective care.”

She said she thinks more consumers are checking prices before obtaining medical care.

Consumer advocates have complained that many patients lack the knowledge and tools to shop wisely for care, Kaiser Health News reported last year. The Kaiser article noted that the prices of even basic procedures such as radiology scans are often not easy to find out beforehand.

Many consumers have responded to high-deductible plans in the most basic way: by using fewer medical services, KHN reported.

In 2014, total annual health spending was $659 less per person in high-deductible plans, or 13 percent, than in conventional plans, according to analysis by the Health Care Cost Institute of claims for 40 million employees covered by Aetna, Humana and UnitedHealthcare.

What’s hard to tell is whether the savings came from avoiding needless tests and procedures or whether employees were skipping important treatment, KHN noted.

Employers in the Mercer survey in Georgia said they expect to hold their premium increase for 2018 to 4.4 percent by making changes to benefits or the insurers used.

In Georgia, 68 percent of all employees covered are enrolled in PPO/POS plans, 5 percent in HMOs, and 27 percent in consumer-driven health plans. The median PPO individual deductible per person is $800 in Georgia, while the national figure is $1,500, May said.

Georgia employers “are a little more generous,’’ she added.