Is Georgia’s health insurance exchange heading for another big insurer pullout?

A research report last week indicated that the parent company of Blue Cross and Blue Shield of Georgia may be moving toward withdrawing from a large percentage of exchange markets nationally.

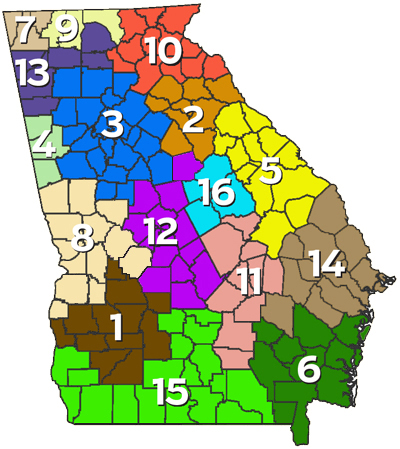

In Georgia, Blue Cross is currently the only exchange health insurer in 96 of the 159 counties. Even a partial pullout would create a vacuum in areas of the state.

Anthem Inc., the parent company of Blue Cross and Blue Shield of Georgia, “is leaning toward exiting a high percentage of the 144 rating regions in which it currently participates,” Jefferies analysts David Windley and David Styblo said in a research report.

Company officials issued a statement to GHN that said they’re evaluating the situation.

“Anthem and Blue Cross and Blue Shield of Georgia have served consumers in the individual health insurance market for over seven decades,’’ said the statement from a Blue Cross of Georgia spokeswoman, Debbie Diamond. “Since the launch of the ACA [exchanges] in 2014, we have been in continuous dialogue with previous and current administrations and Congress to emphasize the importance of regulatory and statutory changes in order to ensure sustainability and affordability of the Individual market for consumers. We continue to actively pursue policy changes that will help with market stabilization and achieve the common goal of making quality health care more affordable and accessible for all.”

Diamond declined to answer questions beyond the statement.

Competition in the metro Atlanta exchange is fairly strong, but a Blue Cross pullout in other areas “would have a profound effect on the market,” Bill Custer, a health insurance expert at Georgia State University, said Tuesday.

The Anthem situation reflects the high level of uncertainty surrounding the Affordable Care Act, also known as the ACA or Obamacare, which created the insurance exchanges in states for individuals and families who don’t get job-based or government health insurance.

The ACA was passed in 2010. A recent Republican attempt to repeal and replace it fizzled, but President Donald Trump and congressional leaders are again working on a proposal to overhaul the system.

Giant insurers UnitedHealthcare and Aetna, citing financial losses, have already pulled out of the exchange in Georgia and other states, and Humana has said it will do the same next year.

“All of the insurers are taking a position that they need more market stability,” Custer said.

The report from Jefferies came almost two months after Anthem CEO Joseph Swedish warned that the insurer might decide within months “whether or not we surgically extract ourselves from certain rating regions, or even on a larger scale, depending on the stability of the marketplace,” Bloomberg reported.

Anthem management “currently seems to be leaning toward broader extraction,” the report said.

The Trump administration has already tightened some enrollment rules to promote stability for insurers. And Tom Price of Georgia, the new U.S. Health and Human Services secretary, has promoted a re-insurance program in Alaska that caps insurers’ financial risks against high medical claims. (Here’s a GHN story on that Alaska program.)

Such programs would promote market stability, Custer said.

Insurance companies have only a few weeks before a deadline when they must tell the federal government and states whether they plan to offer coverage on the exchanges in 2018.

The Georgia insurance department is asking insurers that want to offer exchange coverage to submit their proposed rates by May 16, while the federal deadline is June 21. “We want more time to review rates,” said Glenn Allen, a spokesman for the state insurance department.

Two key moves that insurers are looking for from the Trump administration are a promise to continue certain subsidies for those with lower incomes and enforcing the requirement for most people to either have insurance or pay a tax penalty, Kaiser Health News reported.

As a dominant insurer, Blue Cross may be less likely to withdraw from Georgia if those and other rules stay the same, Custer said.

The ACA’s requirement for insurance is very unpopular with Republicans, and the recent health bill that died in Congress would have repealed the penalty for being uninsured.

Blue Cross of Georgia’s CEO told GHN a year ago that the insurer remained committed to the individual coverage market, and had no plans to exit the Georgia exchange.

The state insurance department last year approved an average premium increase of 21.4 percent for Blue Cross for the 2017 health insurance exchange in Georgia. The company earlier had requested an average premium of 15.1 percent, but it raised the request in the wake of Aetna’s pullout from exchanges in Georgia and 10 other states.

Chris Kane, a consultant with DHG Healthcare, said Tuesday that the adage that “all health care is local” does not apply when “decisions at the corporate headquarters of large insurers affect coverage in small towns in Georgia.”

“Yet Anthem and other public companies have an obligation to shareholders to evaluate business opportunities based on complex criteria,’’ Kane said, adding that the individual health insurance market has always been a fragile market.

Blue Cross “is high-profile in Georgia,’’ Kane said. “If Anthem exits the exchanges nationwide, there may be public relations challenges, at least in the short-term’’ for Blue Cross, he said.