The state insurance department Tuesday approved an average premium increase of 21.4 percent for Blue Cross and Blue Shield of Georgia for the 2017 health insurance exchange in Georgia.

The company earlier had requested an average premium of 15.1 percent, but it raised the request in the wake of Aetna’s pullout from exchanges in Georgia and 10 other states last week.

Blue Cross, the largest health insurer in the state, had told GHN late last week that it was considering upping its current premium proposal.

State insurance officials said Tuesday that Blue Cross was the only health insurer to request a new rate after Aetna’s move.

Glenn Allen, spokesman for the agency, said Georgia passed along the exchange premium requests to federal health officials Tuesday, the deadline for the state to do so.

While state approval is a factor, the federal Department of Health and Human Services has the final say on what premiums will be charged on the insurance exchange, where hundreds of thousands of Georgians will get their coverage.

Insurance exchanges help consumers with modest incomes find and buy health insurance. The exchanges were established in all the states under the Affordable Care Act. Georgia, like most states, has opted to leave the running of its exchange up to the federal government.

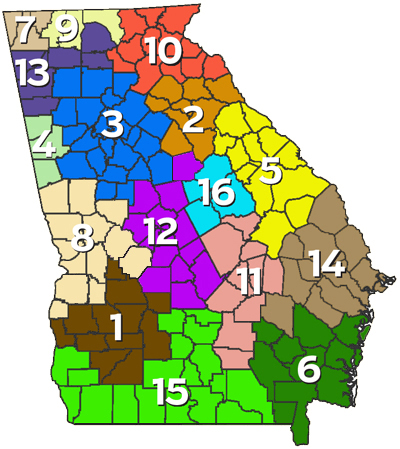

Blue Cross is the only insurer in the Georgia exchange that sells coverage throughout the state. The company expects to pick up many of the estimated 70,000 to 90,000 Georgia Aetna members, who will have to pick new plans during the fall open enrollment.

Aetna had exchange health plans across almost all of the state.

Blue Cross’ original proposed premium increases in May ranged from 9.1 percent to 14.8 percent, but in July the company revised it to an average of 15.1 percent.

A Blue Cross spokeswoman, Debbie Diamond, said in a statement Tuesday to GHN that the company is sticking with the exchange here.

“We are committed to the exchange in Georgia. As the only insurance carrier offering plans in all 159 Georgia counties, we wanted to continue offering quality, affordable plans for Georgians,” she said.

The other health insurers on the Georgia exchange also received state approval for hefty average increases. They are:

** Alliant, 21 percent

** Ambetter (Peach State), 13.7 percent

** Harken Health, 51 percent

** Humana, 67.5 percent

** Kaiser Permanente, 17.6 percent.

None is expected to capture as much market share as Blue Cross.

Georgians whose incomes don’t change much could see their subsidies, or discounts, on exchange plans rise significantly, so the impact of higher rates may be softened, experts say.

The proposed rate hikes reflect, in part, the rise in general health costs of 7 percent to 9 percent annually, caused by factors such as higher use of medical services and increases in inpatient care and pharmaceutical pricing, insurance experts say.

Advocacy groups, including Georgians for a Healthy Future, say consumers should not simply assume their current policy is the correct option, but should shop around during open enrollment to find the plan that suits them best.

A total of 587,845 Georgians signed up for coverage in the insurance exchange for this year, a 9 percent increase over the 2015 total.