Some of the uncertainty over Georgia’s health insurance exchange lifted this week with the state’s biggest insurer filing proposed rates for the 2018 marketplace.

Blue Cross and Blue Shield of Georgia said Friday it was filing rates for all regions of the state.

Blue Cross’ parent company, Anthem, had recently indicated that it was leaning toward exiting a high number of regions in the nation next year, according to a research report.

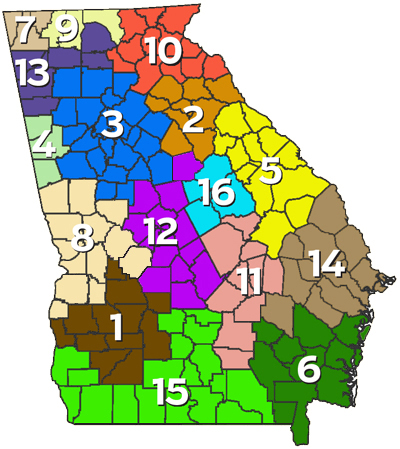

If that had included Georgia, it could have created a vacuum in many areas. This year, Blue Cross is the only exchange health insurer in 96 of the 159 counties.

The state’s Department of Insurance also said Friday that Alliant would be offering plans in the individual exchange in Georgia, and that Humana would serve the small-group exchange.

The filings are just a first step. The proposed rates must be approved, and thereafter an insurer can still decide to withdraw.

Giant insurers UnitedHealthcare and Aetna, citing financial losses, have already pulled out of the exchange in Georgia and other states.

Nationally, the future of the Affordable Care Act exchanges for individuals and families has been under a cloud in recent months.

President Trump and congressional Republicans have vowed to repeal and replace the ACA, and the GOP has developed a proposal to overhaul the system. The latest version of that plan has passed the U.S. House, and is being taken up in the Senate.

The uncertainty has grown with the threat of cutoffs of subsidy payments to insurers that help cover out-of-pocket medical expenses for lower-income people.

More than a dozen Democratic state attorneys general Thursday, seeking to defend those payments, filed a motion to intervene in a case on the subsidies that’s pending in the U.S. Court of Appeals for the District of Columbia Circuit.

Health insurers across the country, meanwhile, are making plans to dramatically raise exchange premiums or exit marketplaces amid doubts about the Trump administration’s management and guidance about the health care situation, the Los Angeles Times reported Thursday.

The growing frustration with the administration’s management — reflected in letters to state regulators and in interviews with more than two dozen senior industry and government officials nationwide — undercuts a White House claim that Obamacare insurance marketplaces are collapsing on their own, the Times reported.

Instead, according to many officials, it is the Trump administration that is driving much of the current instability by refusing to commit to steps to keep markets running, such as funding the insurer subsidies or enforcing penalties for people who go without insurance.

Blue Cross in Georgia told GHN last month that it was evaluating the situation.

“Anthem and Blue Cross and Blue Shield of Georgia have served consumers in the individual health insurance market for over seven decades,’’ said the statement from a Blue Cross of Georgia spokeswoman, Debbie Diamond, in April. “Since the launch of the ACA [exchanges] in 2014, we have been in continuous dialogue with previous and current administrations and Congress to emphasize the importance of regulatory and statutory changes in order to ensure sustainability and affordability of the Individual market for consumers. We continue to actively pursue policy changes that will help with market stabilization and achieve the common goal of making quality health care more affordable and accessible for all.”

Competition in the metro Atlanta exchange is fairly strong, but a Blue Cross pullout in other areas “would have a profound effect on the market,” Bill Custer, a health insurance expert at Georgia State University, said recently.

Custer said Friday that the Blue Cross filing “is good news.” Georgia will avoid the situation in other states where there is no insurer for some areas, he added.

“There will be a functioning exchange in Georgia in 2018, given Blue Cross’ participation,” he said.

An Alliant official told GHN on Friday that it plans to offer coverage across the northern part of the state.

The Georgia insurance department had asked insurers that want to offer exchange coverage to submit their proposed rates by May 16, while the federal deadline is June 21.

The proposed rates will be publicly available after June 21, the agency said.