By Brian Eason, AJC

Editor’s note: This article is reprinted with permission of the Atlanta Journal-Constitution. WebMD and Georgia Health News broke the story in July 2019 of the potential dangers of cancer-causing ethylene oxide in three census tracts in metro Atlanta.

Years before the neighbors of a medical sterilization plant near Smyrna knew that the facility’s emissions could be putting them at risk of cancer, two private equity firms began extracting more than $2 billion from the company that operates it.

The money, which came from an avalanche of risky debt, was used to pay shareholders and executives at the firms. But the moves left the company’s finances in a tenuous position at a critical juncture.

Over the last three years, hundreds of cancer patients in Georgia and Illinois have sued the company, claiming that ethylene oxide emissions from its plants caused their illnesses. Another lawsuit, from the attorney general of New Mexico, accuses the company of misleading the public about the health dangers its emissions pose.

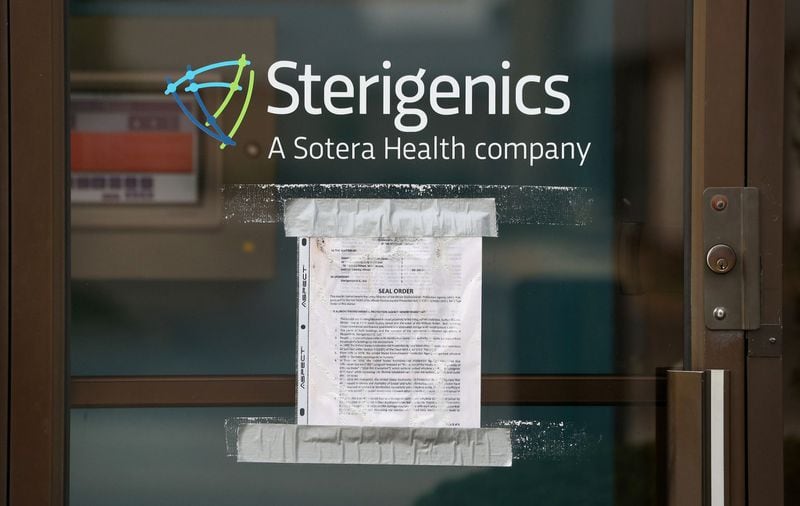

At the same time, Sterigenics faces ongoing pressure from federal regulators who might mandate new and potentially costly safety measures to protect residents from a gas that the U.S. Environmental Protection Agency now considers a potent carcinogen.

As its potential liabilities mount, a new concern looms.

If the lawsuits are successful, the company may not have the money to pay out damages or make improvements after its private equity owners, Warburg Pincus and GTCR, left it saddled with high-priced debt.

The firms’ financial maneuvers have implications not just for Sterigenics and those who live near its plants. Federal health officials have warned that there could be a nationwide shortage of medical devices if Sterigenics — the country’s largest medical sterilization firm — were forced to suspend more of its operations.

The Atlanta Journal-Constitution reviewed thousands of pages of public financial disclosures, court documents, rating agency actions and federal regulatory dockets to shed light on a company that plays an outsized and long-overlooked role in the country’s health care system.

Over a five-year period beginning in 2015, company owners directed Sterigenics to borrow more than $2 billion. At the time, the firms knew that the sterilization process was under scrutiny from federal environmental regulators, who may force ethylene oxide users to invest in costly new emissions controls to protect public health.

Sterigenics did make some facility upgrades during this period, such as installing new emissions controls at its Cobb County plant. But that wasn’t the purpose of the debt, which instead was used to pay the firms and their investors.

Sterigenics paid down about half the debt in 2020 after shares in the company were sold to the public, according to S&P Global Ratings. Its credit was upgraded, however its debt issues still carry a junk rating. The company borrowed at interest rates as high as 8.9% to finance the payouts.

Today, Warburg Pincus and GTCR own 62% of Sterigenics and its parent company, Sotera Health, according to S&P.

Representatives for Warburg Pincus and GTCR declined to comment for the story. Company officials discussed a number of financial risks in its 2020 annual report to investors, which says its insurance “may not be adequate to cover any liabilities arising” from the litigation.

A Sterigenics spokesman declined an interview request, but issued statements in response to the AJC’s questions.

“The company operates safely and in compliance with regulatory requirements and continues to invest in voluntary emission controls to perform better than even the strictest regulations as it continues to fulfill its critical role in healthcare,” one of the statements says. “As it fulfills that role, Sterigenics remains well-positioned to support the critical needs of patients and health care workers and to deliver value for all stakeholders.”

A second statement says: “Any assertion that the company took actions with respect to capital structure at the expense of safety is categorically false.”

Payouts increase

The neighbors of the Cobb County facility remained in the dark about the health risks until July 2019. That month, news reports revealed an EPA study showing that residents near the Georgia Sterigenics plant face elevated cancer risks due to the ethylene oxide gas.

By that point, company officials had known for decades that their emissions might be a threat to public health.

Public documents show they were anticipating stricter environmental controls as early as 1998, and were lobbying against stricter federal regulations as early as 2006. That year, the agency published a draft assessment concluding that the gas was far more likely to cause cancer than previously known.

Studies of thousands of workers exposed to the gas found elevated risks of cancers like leukemia among men, and breast cancer among women. Young children may be especially susceptible, the EPA found.

The findings would have an outsized impact on Sterigenics. The San Francisco-based firm handles 38% of all the ethylene oxide used by medical sterilizers across the country, according to EPA estimates. That’s more than twice as much as the second largest firm.

In comments to the EPA at the time, Sterigenics officials disputed the research. The risks posed by ethylene oxide, they wrote, are “thousands of times less than portrayed by the EPA.” The company also warned federal regulators that medical device makers might switch to less effective forms of sterilization, to the detriment of patients.

The EPA wouldn’t finalize its assessment until December 2016. But in the meantime, the two private equity firms began using the company’s credit to pay themselves and their investors.

The AJC confirmed these transactions via rating agency notices, company filings with the U.S. Securities and Exchange Commission and information provided by Pitchbook, a market research database. Identities of individual investors in the firms are not publicly available.

First, in 2015, GTCR sold a majority stake in the company to Warburg Pincus, financed by $1.6 billion in company debt. Over the next four years, Sterigenics borrowed at least $1.1 billion more to fund cash payouts to its owners.

That includes $320 million borrowed in July 2019, the same month the news of ethylene oxide’s elevated cancer risks reached the public.

Sterigenics contends that the EPA risk assessment doesn’t properly account for background levels of ethylene oxide produced by other sources, like vehicle emissions. And since the report was released, the company has made upgrades to its metro Atlanta plant that it says eliminates nearly all emissions.

In the months following the new assessment, public backlash and legal battles led Sterigenics to temporarily shutter its Cobb facility, and permanently abandon another in Illinois. The two closures, combined with the temporary shutdown of an Illinois facility owned by Medline Industries, alarmed federal officials.

But while health officials fretted over the nation’s medical supplies, Sterigenics’ owners directed the company to continue borrowing to pay investors.

In November 2019, while its Cobb County plant remained closed, the company refinanced $2.9 billion in debt it had on the books and made a $309 million dividend payout before taking the company public.

A year later, the industry pushback against the EPA became more explicitly about money.

The Ethylene Oxide Sterilization Association, on which a Sterigenics official is a board member, protested in a 2020 letter that many of the emission controls the EPA is now considering would have significant “cost and efficiency implications,” threatening the nation’s medical supplies amid a pandemic.

That year, the bulk of Sterigenics’ spending was devoted to debt payments, rather than emission controls — 68% of its net cash flow from operating activities in 2020, according to the company’s annual report to the SEC.

Lawsuit: Payouts harm neighbors

In a 2015 announcement of Warburg Pincus taking a majority stake in the company from GTCR, Sterigenics officials issued a statement praising the two private equity firms’ ownership.

“Their commitment enables Sterigenics to accelerate our growth, invest further capital to serve customers and build out our global scale,” the statement said.

But experts say the two firms’ tactics are fundamentally incompatible with investing in a company’s future, even though they are not unusual for private equity.

When firms borrow to fund buyouts and dividends, the portfolio companies they own “have nothing left to invest in themselves,” said Eileen Appelbaum, an economist who researches private equity. “Their cash flow is completely eaten up by debt service.”

Appelbaum, co-director of the Center for Economic and Policy Research, said that scenario led to the 2017 bankruptcy filing of the once-profitable Toys R Us.

The 2015 Sterigenics acquisition, in which $1.6 billion in debt was used to buy shares from GTCR and make Warburg Pincus the majority owner, is known as a leveraged buyout. The subsequent payouts to both firms, known as dividend recapitalizations, follow the same formula, experts said: The company borrows, the investors take home the money.

“Dividend recaps, I think, are often really a confusing concept for people to wrap their heads around,” said Eileen O’Grady, a researcher for the Private Equity Stakeholder Project, a group critical of private equity. “And part of why that is, is it’s so unbelievably ridiculous that it’s allowed.

“The fact that private equity firms can load companies they own with debt and use that debt to pay themselves hundreds of millions of dollars in cash without making any substantial improvements to the company, it really seems like it should be illegal.”

At the height of Sterigenics’ borrowing in 2016, the firm was downgraded by two major rating agencies, which blamed its private equity owners for the company’s debt.

A lawsuit in Illinois alleges that these payouts prevented the company from investing in needed safety measures. Moreover, the suit alleges, the payouts were timed to ensure the private equity firms could cash out and walk away, leaving the company unable to pay out damages to victims.

In a statement to the AJC, a Sterigenics spokesman denied that the company’s financial decisions compromised public safety. While its Illinois facility never re-opened, the company installed new emissions controls in Georgia that it says exceed both state and federal standards. Those standards haven’t been updated since the EPA’s 2016 assessment, but reviews are underway.

“These investments establish the Atlanta facility as one of the most advanced sterilization facilities in the United States in terms of emission control and the effectiveness of those emissions control systems has been verified by (Georgia Environmental Protection Division) inspections and third-party tests,” a company statement says.

“While we sympathize with anyone dealing with cancer, we are confident our operations are not responsible for causing the illnesses alleged in any lawsuit.”

It’s unclear if Sterigenics’ insurance would cover any lawsuit damages if they are awarded. In August 2021, Sterigenics’ parent company sued its insurer, alleging it has wrongly attempted to deny coverage. The suit asks a federal judge to order the insurance company to help defend against the litigation.

The company’s revenue has increased each of the last four years. But financial disclosures show the company has spent far less on environmental upgrades than it spent on payouts.

From 2018 to 2020, Sterigenics spent an average of $52 million a year on capital expenses at its facilities across the globe, including $6.9 million on environmental upgrades last year. The company did not disclose environmental-related costs prior to 2020 and did not respond to an AJC question seeking the amount.

In 2018, the company paid $170.2 million to investors and top executives, according to federal filings. In 2019, that figure grew to $663 million.

The year the company went public under parent Sotera Health, the payouts abruptly stopped. Sotera paid zero in dividends in 2020. Appelbaum, the economist, says that is no surprise. Now that the company is publicly traded, the private equity firms would have to share any dividends with outside shareholders.

Executive compensation, however, increased substantially. Sotera’s Chairman and CEO Michael Petras made $17.2 million in 2020, up from $2.5 million a year earlier.

When briefed on the article’s findings, Janet Rau, the leader of the Stop Sterigenics advocacy group in Cobb County, said the company’s financial history was frustrating, but not a shock.

“It just shows … that it really is truly only about the money,” Rau said.

How we got the story:

The Atlanta Journal-Constitution reviewed thousands of pages of documents from a variety of sources to assess the financial health of Sterigenics, including financial disclosures to the SEC; rating agency notices from Moody’s and S&P; documentation provided by a market research database; and federal regulatory dockets to review the company’s interactions with the federal regulators. The AJC also consulted experts on private equity companies to better understand the firms’ business practices.

Sterigenics timeline:

Nov. 1998: In a filing with the U.S. Securities and Exchange Commission, Sterigenics discloses to investors that ethylene oxide is a cancer risk and that new environmental regulations could impose substantial costs on the company.

Aug. 2006: The U.S. Environmental Protection Agency publishes a draft assessment concluding that ethylene oxide is significantly more likely to cause cancer than previously known.

Nov. 2006: Sterigenics disputes the EPA’s findings.

March 2011: Private equity firm GTCR acquires Sterigenics for an estimated $675 million, a significant portion of which was paid with debt.

May 2015: Private equity firm Warburg Pincus acquires a majority stake in Sterigenics, paying for a significant portion of the purchase with $1.6 billion in debt.

Oct. 2016: Sterigenics borrows $350 million to pay dividends to shareholders.

Dec. 2016: EPA finalizes its assessment that ethylene oxide causes cancer.

Nov. 2017: Sterigenics borrows $175 million to pay dividends to shareholders

Aug. 2018: EPA releases its National Air Toxics Assessment, which flagged neighborhoods near Sterigenics facilities as elevated cancer risks.

Feb. 2019: The Illinois Environmental Protection Agency orders Sterigenics to close a facility near Chicago.

July 2019: Sterigenics borrows $320 million to pay dividends to shareholders. WebMD and Georgia Health News publicize the 2018 EPA report showing elevated cancer risks near the Cobb County facility.

Aug. 2019: Sterigenics temporarily closes its plant near Smyrna to install new emissions controls.

Nov. 2019: Sterigenics borrows $2.9 billion to refinance its debt and fund a $309 million payment to shareholders.

Nov. 2020: Sterigenics’ parent company Sotera Health raises $1.2 billion by selling stock to public investors, using the proceeds to pay down debt and buy shares from executives.

March 2021: Sterigenics discloses to investors that insurance may not cover litigation filed by people claiming the company caused their cancer.

Aug. 2021: Sterigenics sues its insurer asking a federal court to force the insurance company to help pay the costs of litigation.

Sources: Moody’s Investors Service, S&P Global Ratings, Pitchbook, U.S. Securities and Exchange Commission filings, federal regulatory dockets, court documents.

Brian Eason covers Cobb County for the AJC’s local government team.

This story comes from our partners at The Atlanta Journal-Constitution. For more on the news and events in metro-Atlanta and Georgia, visit AJC.com.