The parent company of Georgia’s biggest health insurer is exiting Ohio’s health insurance exchange for 2018.

Anthem’s pullout could apparently leave as many as 20 counties in the Buckeye State with no insurer in the state’s exchange, created by the Affordable Care Act.

Will the next Anthem pullout come in Georgia?

Its company here, Blue Cross and Blue Shield of Georgia, signaled last month that it would stay in Georgia’s exchange, filing proposed rates for coverage next year. But the uncertainty surrounding the exchanges across the nation may lead the insurer to reconsider its participation here, experts say.

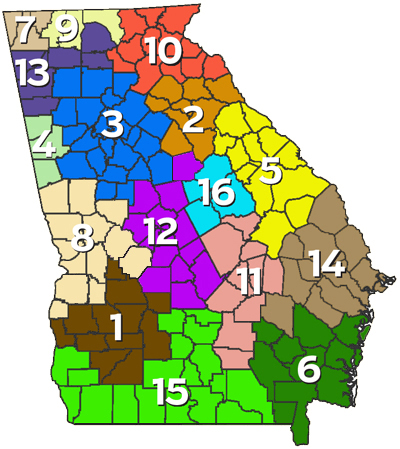

Blue Cross is the only statewide health insurer in the Georgia exchange, and is the sole exchange offering in 96 of the 159 counties.

Anthem, in explaining what it called “a difficult decision” in Ohio, pointed to continued “volatility” in the individual health plan market, and to uncertainty about whether President Trump and the Republican-controlled Congress will allow continued reimbursement of insurers for subsidies on some policies bought on the exchanges, CNBC reported.

These subsidies lower the costs of policies for many low-income exchange customers, making it possible for them to afford the coverage.

A Blue Cross of Georgia spokeswoman Tuesday acknowledged that the exchange market remains volatile and unpredictable.

“For more than seven decades, Blue Cross and Blue Shield of Georgia has served consumers in the Individual market and throughout that time our commitment has remained the same: to provide greater access to affordable, quality health care,’’ said the spokeswoman, Debbie Diamond, in a statement. “While we are pleased that some steps are being taken to address the sustainability of the marketplace, the fact is the individual market remains volatile.

“Recognizing the dynamics and level of volatility in the individual ACA-compliant product offerings, considering any changes to our footprint in Georgia requires a thoughtful approach.

“To that end, we remain in active dialogue with state leaders and [Department of Insurance] regulators in hopes that we can find a sustainable path moving forward before we are required to make a decision. As the individual marketplace continues to evolve, Blue Cross and Blue Shield of Georgia will continue to advocate solutions to ensure long-term stability in the market.”

The filings of proposed premiums by Blue Cross, announced last month, do not guarantee that the company will remain an exchange participant for next year.

Bill Custer, a health insurance expert at Georgia State University, said insurers’ hesitancy over the exchanges in 2018 is understandable.

“The [Trump] administration simply has not given any assurances that cost-sharing subsidies will stay in place, or whether they’ll market the exchange’’ to consumers, Custer said Tuesday. “That uncertainty will give a lot of insurers pause.”

The situation, though, “can certainly be salvaged,’’ Custer said. “The administration has to decide what they’re going to do in 2018.”

Anthem, which is selling ACA exchange plans in 14 states this year, has left open the door to dropping out of other states next year, CNBC reported.

The company also blamed the restoration of a tax on insurers.

“An increasing lack of overall predictability simply does not provide a sustainable path forward to provide affordable plan choices for consumers,” said Anthem.

“As the Individual marketplace continues to evolve, Anthem will continue to advocate solutions that will stabilize the market to allow us to return to a more robust presence in the future,” the company said.

Giant insurers UnitedHealthcare and Aetna, citing financial losses, have already pulled out of the exchange in Georgia and other states.

Nationally, the future of the Affordable Care Act exchanges for individuals and families has been cloudy in recent months.

Trump and congressional Republicans have vowed to repeal and replace the ACA, often known as Obamacare, and the GOP has developed its own proposal to overhaul the system. The latest version of that plan has passed the U.S. House, and is being taken up in the Senate.

Insurance regulators across the country, meanwhile, have reported that insurers have submitted premium rate increases of up to 50 percent and 60 percent or even higher for 2018, Reuters reported.