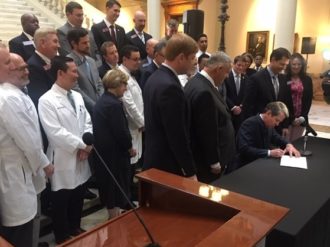

Just one of Gov. Brian Kemp’s waiver proposals was unveiled Thursday. But that one part, announced at the state Capitol, is still a lot to grasp. The so-called 1332 waiver proposal is designed to make fundamental changes in the health insurance system for individuals and families in the state. The goal is to make coverage…

Tag: Health Reform

Uninsured rate for Georgia children shows troubling rise

Georgia had a spike in its rate of uninsured children between 2016 and 2018, according to a report released Wednesday. The state in 2018 had an uninsured rate among children of 8.1 percent, up from 6.7 percent two years before. Only Tennessee’s rise of 1.5 percentage points was a greater increase in the U.S. over…

Rebate time: Thousands of Ambetter clients to get money back

About 190,000 Georgians with health care policies from Ambetter of Peach State are getting rebates of $314 each. The payouts are required under a rule in the Affordable Care Act. The insurer owes a total of $59.8 million to its individual policyholders in Georgia, according to newly released federal figures. That’s a large chunk of…

Abrams says waiver effort won’t fix Georgia’s health care problems

Former Democratic gubernatorial candidate Stacey Abrams told reporters Wednesday that Georgia’s proposed health care waivers are “shortsighted’’ and will leave hundreds of thousands without health insurance. During last year’s gubernatorial campaign, Abrams pushed for the state to adopt full expansion of Medicaid under the Affordable Care Act. She was narrowly defeated by Brian Kemp, who…

Gainesville-based system warns of potential break with Anthem

Northeast Georgia Health System has sent letters to 40,000 patients, warning them that its contract with Anthem Blue Cross and Blue Shield may end Sept. 30 without a new agreement. The Gainesville-based system said that Anthem is seeking “drastic cuts’’ in payments for medical services. Anthem is making decisions on local networks from its Indianapolis…

Patients ‘frustrated’ as WellStar, Anthem near end of contract

The vast majority of contract disputes between health insurers and hospital systems get settled before the existing deal lapses. The agreement comes sometimes within hours of the deadline. One notable exception occurred last year, when Piedmont Healthcare’s contract with Blue Cross and Blue Shield of Georgia expired without a deal. And now the standoff between…

‘Waiver’ on the way? Kemp signals a plan to increase coverage

It looks as though Gov. Brian Kemp will indeed pursue a Medicaid “waiver’’ proposal to expand health coverage in Georgia. Kemp, in his State of the State speech Thursday — three days after he was sworn in as Georgia’s new chief executive — said he will seek “to expand access [to care] without expanding a…

Exchange enrollment extended in counties ravaged by hurricane

Federal health officials have extended the enrollment deadline for people in South Georgia affected by Hurricane Michael. They can enroll in the Affordable Care Act exchange till Feb. 20. Floridians affected by the storm also have an extended sign-up period. The national deadline was Dec. 15 to enroll in 2019 coverage. At least 20 counties…

With late spurt, exchange enrollment almost catches up to last year’s total

After an “avalanche’’ of sign-ups in the past week, Georgia’s final enrollment in the health insurance exchange reached close to last year’s figure. The number of late sign-ups was a surprise because enrollment had been lagging significantly just a few days ago. Federal health officials announced that the preliminary sign-up number for 2019 coverage was…

Is Obamacare at risk? Texas court ruling on ACA sparks concern

The Affordable Care Act has withstood dozens of repeal attempts in Congress and two strong Supreme Court challenges. Now the 2010 health law, also known as Obamacare, will have to survive another major test. On Friday, a federal judge in Texas struck down the ACA as unconstitutional, siding with a group of Republican attorneys general…