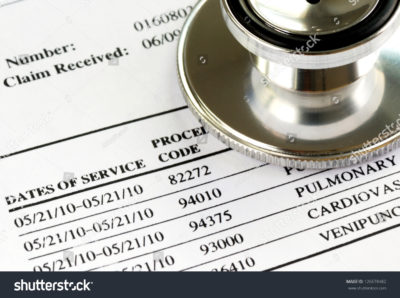

Consumers often have no idea about what they will pay for a medical procedure – or about the quality of care they can expect to receive.

But under a bill discussed Monday in state Senate committee hearing, more Georgia patients with insurance could get access to such information.

Senate Bill 303 is part of a general legislative push for greater transparency in medical prices.

The transparency effort includes proposals on what’s known as surprise billing, when a patient receives care from a network hospital but gets an unexpected bill from a non-network provider involved in the care. A bill addressing surprise billing was approved by a House panel Monday.

The Senate Insurance and Labor Committee, at a separate hearing, did not take a vote on Senate Bill 303.

The “Georgia Right to Shop Act’’ legislation, as it’s also known, would allow patients to query their insurance company, either online or on the phone, on what out-of-pocket costs they would face if they use a particular medical provider. Consumers would also get data on the quality record a doctor or hospital has in providing that medical service.

“Competition helps us all,’’ said Republican Sen. Ben Watson, a Savannah physician who’s the bill’s lead sponsor. “We’re trying to make transparent what the cost is and what the quality is.’’

The legislation drew some star power: Atlanta-based consumer advocate Clark Howard testified in favor of the bill.

Howard, who’s known nationally as an author and broadcaster, noted in his testimony that patients with insurance can face large out-of-pocket costs, including average deductibles nationally of $1,600. That puts the consumer on the hook for paying all medical costs up to that point.

“The quality of care and outcome is not at all determined by the price you pay,’’ Howard told the committee.

”You can pay a massive price difference’’ for the same procedure from one hospital to another, Howard said. Using an automotive analogy, Howard said a patient who receives care can end up paying more for a used Chevy than a new Mercedes.

The proposal, if approved, would lead to an insurer’s website posting information about quality, such as rates of hospital readmissions and of adverse patient events.

Watson said some patients, especially those who have high-deductible insurance, already comparison-shop as much as possible.

Sen. Larry Walker, a Perry Republican who’s an insurance agent, said the Senate bill represents “a big paradigm shift’’ in health care.

Hospital groups cautious

Hospital groups told the Senate panel that they support the overall transparency effort.

Still, Kathy Polvino, an attorney for the Georgia Alliance of Community Hospitals, said the definition of emergency services used in the legislation is too narrow.

And Keri Conley, a Georgia Hospital Association attorney, said that current information about hospital quality is often skewed based on the patient’s underlying medical problems, and that the data are sometimes outdated.

Another objection was raised by Allan Hayes of the America’s Health Insurance Plans, who said the pricing information would reveal insurers’ contracted rates for medical services. “We’d have concern making this publicly available,’’ Hayes said.

It’s not immediately clear whether the bill, if approved, would apply to all insurance plans, or just those that the state directly regulates.

Watson said a few states have passed similar legislation, including Tennessee. He added that he’s optimistic that the bill will pass, and that the wording will likely change during the legislative process.

Another physician in the General Assembly, Rep. Mark Newton (R-Augusta), championed a bill Monday that would promote more information for consumers to help them avoid surprise billing situations. It won committee approval with one dissenting vote.

A patient who has a procedure, thinking it is totally in network, can be shocked to find out later that a non-network doctor played a role and has sent a large bill. This kind of unforeseen expense “can be devastating to a family’s finances,’’ Newton told the House Special Committee on Access to Quality Health Care, which he chairs.

House Bill 789 would also focus on an insurer’s website. It would allow a patient to find information on whether an insurer’s network hospitals have ER physicians, anesthesiologists, radiologists and pathologists who are in network as well.

A hospital would have a “surprise-billing rating’’ along with other information on its website.

For instance, Newton said, a patient scheduling elective surgery could determine from the website whether the anesthesiologist involved, and not just the surgeon, is a network provider.

“That’s the transparency piece of it,’’ Newton said.

He added that the legislation, if passed, could put pressure on insurers, physicians and hospitals to reach more contract agreements on these services.

Polvino of the Alliance of Community Hospitals said the legislation could force hospitals to be in the middle of negotiations between an insurer and a physician group.

The rating system, she said, could “carry a negative connotation about a hospital.’’

“Patients may not know what it means,’’ she added.

Rep. Sharon Cooper (R-Marietta), though, said the check-mark rating system created by the bill “doesn’t mean it’s a negative.’’ Patients have a right to that information, she said.

Newton said a major feature of the bill is that it would extend to all insurers’ plans in Georgia, not just those regulated by the state.