Confused about the fate of “repeal and replace,” about big premium hikes, about “insurer bailouts’’’ being eliminated?

The political roller coaster that the Affordable Care Act has been riding may have left you wondering what is still standing in terms of the 2010 health law.

Actually, much remains the same. Not only is the ACA still in place, but so is its requirement for most people to get health coverage or pay a tax penalty.

But there are some changes this year that consumers need to know about. One major difference is that the sign-up period for buying insurance on the ACA exchanges has been shortened. Open Enrollment for 2018 starts Nov. 1, next Wednesday, and runs through Dec. 15. That’s only about six weeks.

As usual, a big surge is expected in the last few days of the enrollment period. That’s why it’s particularly important this year, enrollment experts say, for people who need coverage to search for a health plan early. Those who wait till the last minute could run into problems.

“It’s very important for consumers to shop early,’’ said Sarah Sessoms of Insure Georgia, an organization that helps consumers sign up for coverage, during a briefing with reporters Tuesday.

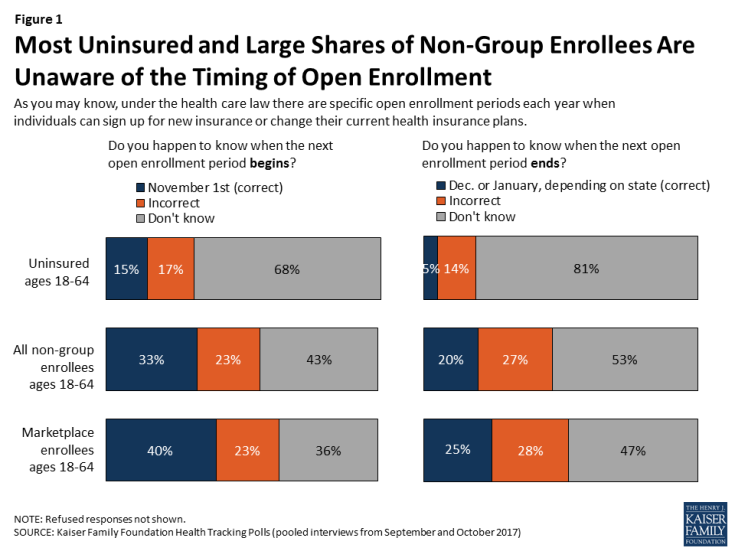

A recent Kaiser Family Foundation tracking poll found that only 15 percent of uninsured people, and only 40 percent of those with an ACA exchange plan, knew when enrollment starts this year.

And about 30 percent of Americans think the ACA’s coverage mandate has been eliminated or don’t know it’s still in effect, the Kaiser Family Foundation’s Karen Pollitz said Tuesday. Though there has been a congressional push this year to scrap the requirement to have insurance — and discussion in the White House about doing away with it by executive action — it remains in place.

“We think people are confused not only about whether the [ACA] exists, but also whether it will continue through 2018, and whether financial help is still available, and how to enroll,’’ Laura Colbert, executive director of the consumer group Georgians for a Healthy Future, said Tuesday.

Financial help does still exist for most people in the exchange. Despite the headlines of big premium increases, a large majority of exchange customers will be sheltered from the upcoming spike for 2018 due to a corresponding increase in their subsidy or discount.

“It’s extremely important for consumers not to be discouraged’’ by news of premium hikes, Pollitz said.

Ninety percent of Georgians getting exchange coverage had a subsidy this year, which lowered the average monthly premium from an average of $431 to $122 a month, according to Georgians for a Healthy Future in a report released Tuesday.

People with incomes up to 400 percent of poverty (about $48,000 for an individual) can qualify for these subsidies or tax credits to help pay for premiums.

Enrollment may fall

The insurance exchange was created by the ACA for people who do not get job-based or government coverage. About 404,000 began coverage in the exchange in Georgia this year, but overall the number declined from 2016, when 478,000 paid for a plan.

The most dramatic enrollment declines were seen in rural counties, where drops of up to 36 percent were recorded, the Georgians for a Healthy Future report said. Rural Georgians generally have had much less choice of insurers than those in metro Atlanta.

The enrollment decline was caused by multiple factors, Colbert said. She cited the uncertainty over the ACA in the wake of last year’s presidential election; the more limited choice of insurers; and the rise in premiums for people who do not receive subsidies.

Almost half of Georgia’s exchange customers this year live in the state’s five most populous counties, with the highest overall enrollment in Gwinnett County for the third year in a row.

Recently, there has been confusion about the effect of President Trump’s elimination of federal payments to insurers for ‘’cost-sharing reductions,’’ which he has denounced as “bailouts’’ to these companies.

These payments lower the cost of deductibles, co-pays and co-insurance for many exchange customers. Consumers will still get these reductions. But now, instead of the federal government paying for them, insurers will charge higher premiums to compensate for the loss of this funding.

The four Georgia health insurers offering exchange coverage, in part due to the insurer payment cutoff, are set to raise their premiums by up to 57 percent for 2018 coverage.

Bearing the brunt of those hikes will be people who earn too much money to qualify for individual exchange coverage, Sessoms of Insure Georgia said.

“Many of the consumers we assisted last year that did not qualify for financial assistance did not purchase plans at all,’’ she said.

The enrollment period will not only be shortened but will have more interruptions. The Department of Health and Human Services plans to carry out site maintenance on healthcare.gov, the exchanges’ online platform, for 12 hours on five of the six Sundays during Open Enrollment.

Federal health officials also announced this fall that they would slash the exchanges’ marketing and advertising budget by 90 percent. They made a 61 percent funding cut for Georgia’s health insurance navigator programs, which provide specially trained insurance counselors for exchange customers, and they ended community partnerships and initiatives that promote enrollment among hard-to-reach populations.

Insure Georgia’s funding dropped from about $2.3 million to $329,000.

“With foundation support and help from volunteers we will be able to have a presence in each community and hold roughly as many events a day as last year,’’ Sessoms said. But she added, “We will come nowhere close to matching last year’s enrollment effort.”

Colbert said her group is concerned about the decrease in financial support, advertising and in-person outreach in Georgia and across the nation. “Advertising raises awareness that Open Enrollment is taking place,’’ she said.

She said she expects a decline in exchange enrollment, with her group’s report pointing to additional barriers to enrollment. “We’ll see a similar or larger drop-off because there has been a lot of uncertainty.’’

Here’s more guidance on exchange enrollment from Kaiser Health News