In health insurance, to a great extent, price is king.

The monthly premium that people will have to pay for insurance is a pivotal factor in how they pick a health plan – or whether they choose to buy coverage at all.

The apparent impact of the cost of premiums is noticeable in the enrollment patterns in Georgia’s insurance exchange, as seen in the first year of its existence under the Affordable Care Act.

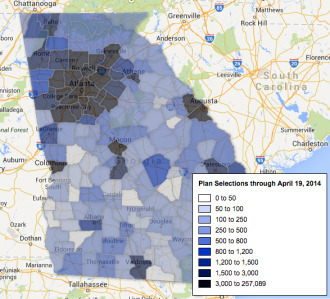

A map of exchange enrollment in Georgia in 2014 shows generally low participation rates in rural South Georgia, even though these counties have high percentages of uninsured residents.

For the current plan year, southwest Georgia in particular had high premiums compared with other Georgia regions. In fact, it had among the highest premiums in the nation.

Two southwestern regions had monthly premiums of $345 and $377 for a particular Silver plan for a 21-year-old, Bill Custer, a health insurance expert at Georgia State University, told reporters in Atlanta on Tuesday.

And enrollment in those two regions was low, he said. The percentage of people enrolled per population under age 65 was 1.3 percent in one region and 1.6 percent in the other. Only one other Georgia district had an exchange enrollment below 2 percent.

The southwest, unlike other main regions of the state, has a single dominant hospital system (based in Albany). Also, many residents of the region have chronic health conditions and therefore high costs, Custer noted.

For the current year, the southwest had only one insurer, Blue Cross and Blue Shield of Georgia, offering exchange coverage.

Meanwhile, metro Atlanta – with a 4.6 percent participation rate in the exchange – had more insurer competition and much lower exchange premiums.

For 2014 coverage, in fact, Georgia had the biggest disparity in premiums within a state, Custer said.

But the 2015 enrollment map may look different, with more insurers offering plans statewide in the exchange.

Blue Cross is lowering its rates for the 2015 year across the board, Custer noted, and Time Insurance, Coventry and United will also offer coverage in all regions of the state.

Competition, he added, “will bring the disparity in rates down.”

During the first open enrollment period, more than 310,000 consumers in Georgia selected marketplace plans, ranking the state fifth in enrollment among states where the federal government operated the exchange.

In addition, since that enrollment period, more than 240,000 Georgians have been determined to be already eligible for Medicaid and PeachCare. The discovery of those people was largely a byproduct of the exchange enrollment process.

Open enrollment begins Nov. 15 for Year Two of the exchange.

A key factor still to play out, though, is the distribution of navigators (specially trained counselors) and other people to help Georgia consumers sign up for the exchange. Rural areas, in particular, did not have as much insurance counseling available as other regions did, experts say.

“There are real [enrollment] gaps in rural Georgia,’’ said Dante McKay, Enroll America director in Georgia. “I suspect that had a lot to do with [a lack of] in-person assistance.”

Consumers who reported having such one-on-one assistance were nearly twice as likely to enroll successfully as those who attempted to sign up online without help, according to Enroll America.

Compared with other states, on a per uninsured basis, Georgia ranked at the bottom in federal funding for in-person assistance, McKay said.

And Georgia is receiving less money this year for navigators than it did last year.

Cindy Zeldin of the consumer group Georgians for a Healthy Future said some areas of the state may have had many low-income uninsured people who did not qualify for subsidies in the exchange, and thus could not afford coverage.

“Some consumers, particularly in hard-to-reach communities with language or other barriers, may not have had access to the information they needed to understand their choices and enroll in a plan that met their needs,’’ she added. “And of course some parts of the state had fewer health plan choices overall.”

“It will be important in this next round of open enrollment for stakeholders, community-based organizations, and advocates to raise awareness about health insurance options and help connect people to enrollment assistance personnel or other resources that can help them find and enroll in a plan that meets their needs,” Zeldin said.

Enroll America’s McKay said the organization is working with community groups around the state, and is seeking financial help from local funding organizations to boost the counselor workforce.

“Our goal is to reach as many people as possible,” McKay said.

Here’s a link to a Kaiser Health News story on how Year 2 of ACA enrollment may be a tougher challenge than the first year